The phrase “writing off bad debt” gets tossed around a lot, and often newly self-employed therapists wonder whether they can deduct unpaid client bills from their taxes.

While the idea you can save on your tax bill every time a client goes AWOL is certainly appealing, the reality of writing off bad debt is more complicated than that.

Here’s everything you need to know about writing off bad debt when you run your own therapy practice.

{{resource}}

Are unpaid therapy sessions bad debt?

First, a definition of “bad debt.” Bad debt is any debt that has become worthless because you’re unable to collect it. Bad debt is only an issue if you use the accrual accounting method. More on that in a moment.

With accrual accounting, debt owed to your business is classified as “accounts receivable,” and listed on your balance sheet as current assets.

If you charge a client $1,000 for services you performed, you enter that transaction in the books under accounts receivable. It counts as $1,000 added to your total assets—along with cash, goods, and other items of value you hold. That applies even if the debt hasn’t been paid yet.

Suppose the client owing you $1,000 goes bankrupt, and can’t pay their bill. That $1,000 is now uncollectible, and becomes bad debt. You now have to take special steps in order to remove that $1,000 from your assets and balance your books.

Cash vs. accrual accounting

Whether you do your own bookkeeping or have it handled by a professional, your books are handled one of two ways: with the accrual method or with the cash basis method.

How accrual accounting works

Using the accrual method, any time you charge a client a fee, you record it as income on the books. That applies even if they haven’t paid yet.

The same goes for expenses. If a contractor sends you a bill, it’s recorded as accounts payable, and added to the liabilities on your balance sheet.

Once you receive cash in hand from the client—or pay your own bill—you complete an extra step, converting your accounts payable or accounts receivable to cash.

Naturally, the entire process is a bit more complicated than that, but those are the fundamentals of how accrual accounting works.

How cash basis accounting works

Using cash basis accounting, you only record transactions on the books once you have cash in hand.

Meaning, you can send out one hundred bills to one hundred clients, but you don’t make a record of the money you’re owed—only the money you’re paid.

The same goes for expenses. A contractor may send you a bill, but the expense isn’t recorded on the books until the cash leaves your bank account.

Because of this, cash basis accounting does not use accounts receivable or accounts payable ledgers.

And here’s the most important thing: if you use the cash basis method, you can’t accumulate bad debt. Since there’s no debt recorded on the books, there’s no debt that can go bad.

{{resource}}

How to write off unpaid sessions with accrual accounting

Many small businesses prefer the cash basis method because of its simplicity. That’s particularly true of small businesses that don’t have the benefit of a bookkeeper to help them and manage the bookkeeping themselves. It’s the most popular method for therapists running their own solo practices.

However, if you do use the accrual method, and you do your own bookkeeping as well, it’s necessary to write any bad debt off the books.

Why write bad debt off the books?

When you have bad debt on the books, your financial records fail to match up with reality.

Remember, money clients owe you is recorded in accounts receivable, and appears as an asset on your balance sheet. But if that money can’t be collected, it’s worth nothing; it’s no longer an asset, and you need to correct your books in order to reflect that.

If bad debt accumulates on your books, your balance sheet will tell you your business has assets it doesn’t really have. And that can lead to cash flow troubles down the line.

How to write bad debt off the books

For a therapy practice billing its clients, bad debt in the form of unpaid bills will typically appear on the books as receivables that cannot be collected.

In that case, the amount of bad debt your business is dealing with is relatively small, so you may wish to use the “direct write-off method.”

In order to remove the bad debt from receivables, you credit your accounts receivable the amount owing, and debit a bad debt expenses account the same amount. This expense account is then paid using your revenues, directly impacting your income.

The biggest benefit of using this method is that it’s straightforward and, for most small businesses dealing with small amounts of bad debt (ie. hundreds, not thousands of dollars’ worth), it won’t seriously disrupt cash flow.

The biggest drawback is that you may end up reporting bad debt in a different accounting period (ie. year) from the one in which you charged it—meaning your receivables and payables aren’t matching for that period. For that reason, direct write-offs go against Generally Accepted Accounting Principles (GAAP).

Larger companies dealing with a significant amount of bad debt each accounting period use the allowance method to write it off. You can see a comparison of the two methods in this article from the Corporate Finance Institute.

If a client doesn’t pay for a therapy session, can I write it off my taxes?

Generally speaking, no. Any bad debt you incur in the course of running your therapy practice is unlikely to be deductible.

The bad debt deduction mostly applies to debt you acquire as part of a business deal. For instance, if you purchased debt from another business, and then found out it was uncollectible, you could write it off.

Since bad debt you incur as a therapist is not an expense, but rather income you never earned, it can’t be deducted.

See the IRS page for the bad debt deduction for more details.

That being said, unpaid bills do reduce your total overall tax liability, since they reduce your taxable income.

If a client pays with insurance, can I write it off?

If a client pays for a $200 session using insurance, and insurance only reimburses you $150, you may be inclined to believe you can write off the remaining $50 as bad debt.

This is not the case. The rate at which you’re reimbursed by the insurance company was agreed upon when you were paneled with them, and any difference between that amount and your advertised rate fails to qualify as either bad debt or a tax deduction.

If I offer a sliding scale, can I write off the difference when a client pays less?

Suppose you typically charge $200 per session, but offer low income clients a sliding scale rate of $40 to $60 per session. If a client pays you $50, can you write off the $150 as bad debt?

In this case, you’ll have to accept generosity as its own reward. The difference between what the client pays and what you’d charge without the sliding scale does not qualify as either bad debt or a tax deduction.

The same applies if you offer some clients special discounted rates or pro bono services.

—

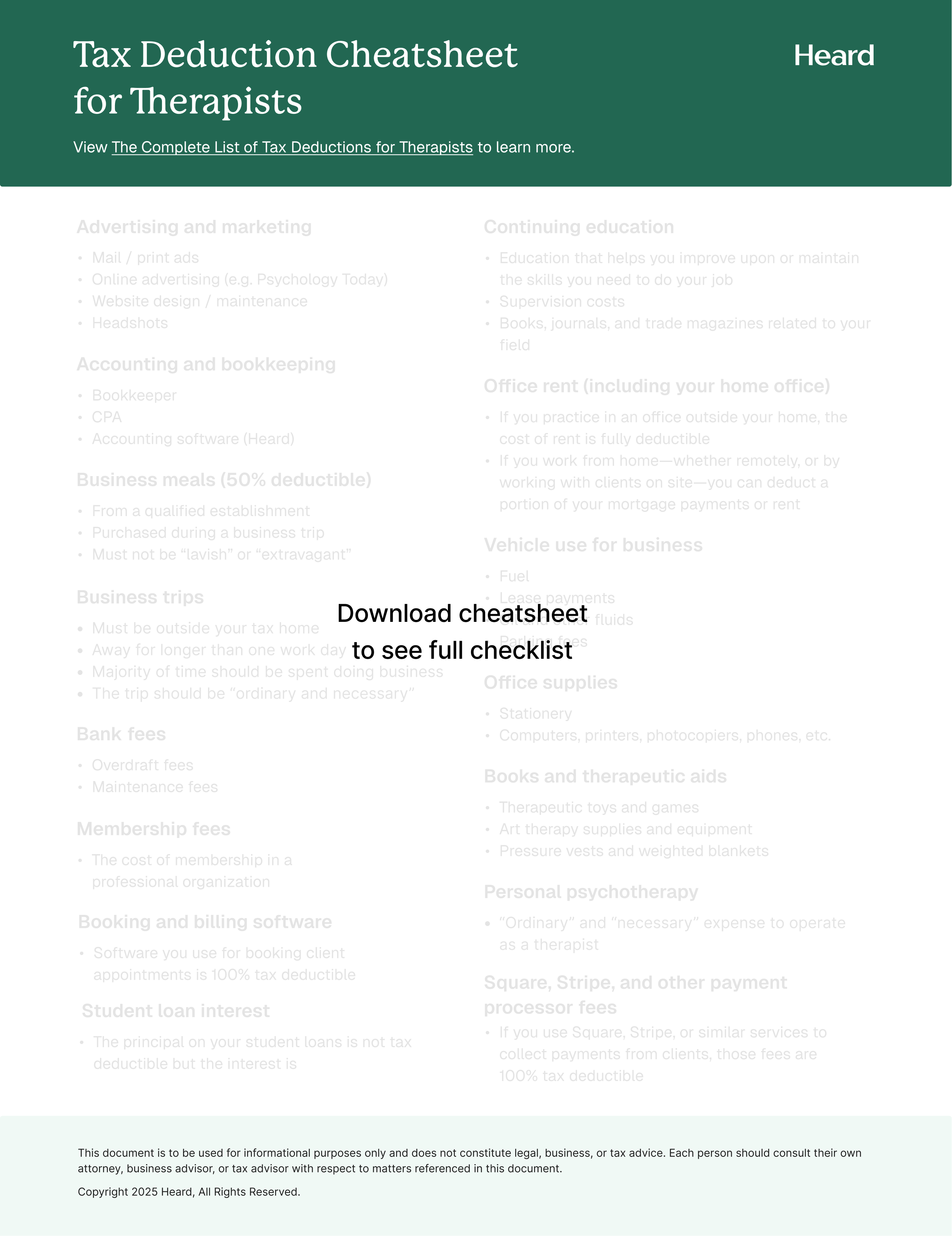

While it’s unlikely you’re able to deduct bad debt from your taxes, there are a lot of other, more straightforward ways to lower your tax bill. Check out our complete guide to tax deductions for therapists.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Bryce Warnes is a West Coast writer specializing in small business finances.

{{cta}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.