The key to stress-free tax filing for your S corporation therapy practice is preparing in advance.

Even if you have an accountant filing your taxes for you, it helps to prepare in advance what information they’ll need in order to get the job done.

And if you can go one step further, and understand which forms make up your S corp tax filing—and the information necessary to fill them out—conversations with your accountant will be much more straightforward than they would be otherwise.

Here’s everything you need to do to prepare to file your taxes as an S corp therapy practice.

{{consult}}

Book time with your accountant

The first step you should take, before you dive into paperwork and the finer points of S corp taxes, is to book a meeting with your accountant during tax season. And if you have any questions prior to year-end about filing taxes, get in touch with your accountant now.

Tax season is the busiest time of the year for accountants, and in some cases their schedules may be full well before the year ends. Book a meeting with them now, so you can file your taxes early next year rather than scrambling to meet deadlines.

Confirm with your accountant what you need to bring to your meeting, and any information you may need to provide beforehand.

If this is your first year filing S corp taxes, check out our guide to hiring an accountant as a therapist.

Heads up: Heard includes S corp tax filing as part of our standard package for S corp therapy practices—and there’s no need to book a call in advance.

Understand how taxes work for S corp therapy practices

Quick refresher: While your S corp is a distinct entity, so long as you’re the only shareholder, 100% of its revenue and expenses pass through to you personally.

That means that every dollar of income your S corp earns as profit is reported on your personal tax return.

At the same time, if you’ve taken the typical approach to setting up a single-member S corp, you’re an employee on your own practice’s payroll. The income you receive as an employee is reported as employment income, and the income of your S corp as a whole is reported as nonpassive income on Form 1040, Schedule E.

If you’re new to running an S corp, or if you’re still not clear on how your personal taxes relate to your S corp’s taxes, check out:

- The Complete Guide to S Corporations for Therapists

- When Should my Therapy Practice Become an S Corp?

- How to Pay Yourself as a Therapist

{{consult}}

Prepare year-end financial statements

Financial statements covering the entire tax year, from January 1 to December 31, provide the information you need to complete your return.

Depending on your accounting method, there are either two or three annual statements you need to prepare:

- A profit and loss statement (P&L), showing your practice’s total profit and losses for the year.

- A balance sheet, showing your practice’s total assets and liabilities at the close of the financial year.

- A cash flow statement, which is only necessary if your practice uses the accrual accounting method. This statement reconciles your cash on hand with your earnings as reported on the books.

In order to prepare these statements, you need a complete set of up-to-date books. If you’ve fallen behind and December 31 is approaching fast, learn how to catch up on bookkeeping for your therapy practice.

Create a list of deductible business expenses

Deductible business expenses are those that, when reported, reduce your total taxable income for the year.

When you’re a sole proprietor, you report deductible expenses on Schedule C of Form 1040. When your practice is an S corp, you report them on Form 1120S.

Not all expenses are fully deductible. Plus, some deductions—like the home office deduction for therapists—require you to do some math in order to determine your total deduction.

Here’s how to make the most of tax deductions for your practice:

- Review our complete list of tax deductions for therapists

- Create a list of deductions you are eligible to claim

- Go back through your books for the year and determine how much you spent on each deductible expense

- Follow any necessary extra steps for calculating the deductible amount of the expense

- Create a working document listing the amount of each deduction, plus their total amount; bring it to your meeting with your accountant when you file your taxes

Adding up all of these deductions now, and making sure you’ve got the numbers right, will make your meeting with your accountant run smoothly and ensure you don’t overlook any expenses that could reduce your tax burden.

But before you claim any deductible expenses, get your records—receipts and other proof of payment—ready; you’ll need them on hand in case of an audit.

{{consult}}

Collect and organize your expense records

In the event of an audit, the IRS requires you to prove that your business actually incurred every expense deducted on your tax returns.

That’s right: tax returns, plural. While the IRS will typically only request up to three years’ worth of supporting documents for past returns, if anything potentially fraudulent crops up—like major expenses that aren’t supported with proof of purchase—they can opt to go back six months in your tax filing history.

That’s why it’s important to make sure you have receipts for any expenses over $75 you intend to claim, and that they’re organized and carefully stored.

For help getting started, see Do Therapists Need to Save Paper Receipts?

Understand your S corp tax forms

You have a better sense of how your business operates when you understand what goes into its annual federal tax filing.

If your therapy practice is an S corp and you’re and employee, your tax forms will include (at minimum) the following:

- Form 1120S (US Income Tax Return for an S Corporation)

- Schedule K-1 of Form 1120S (Shareholder's Share of Income, Deductions, Credits, etc.)

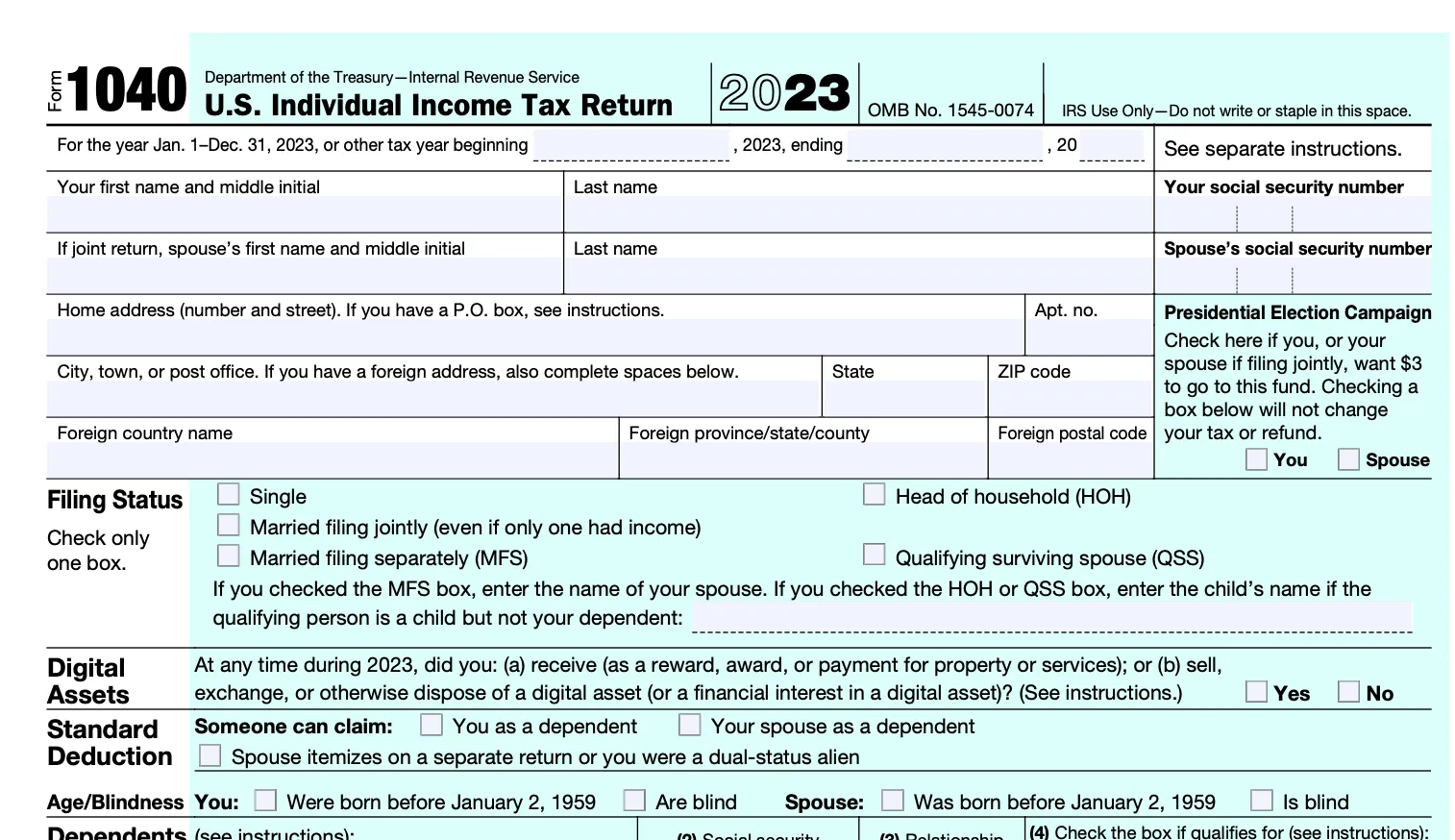

- Form 1040 (US Individual Income Tax Return)

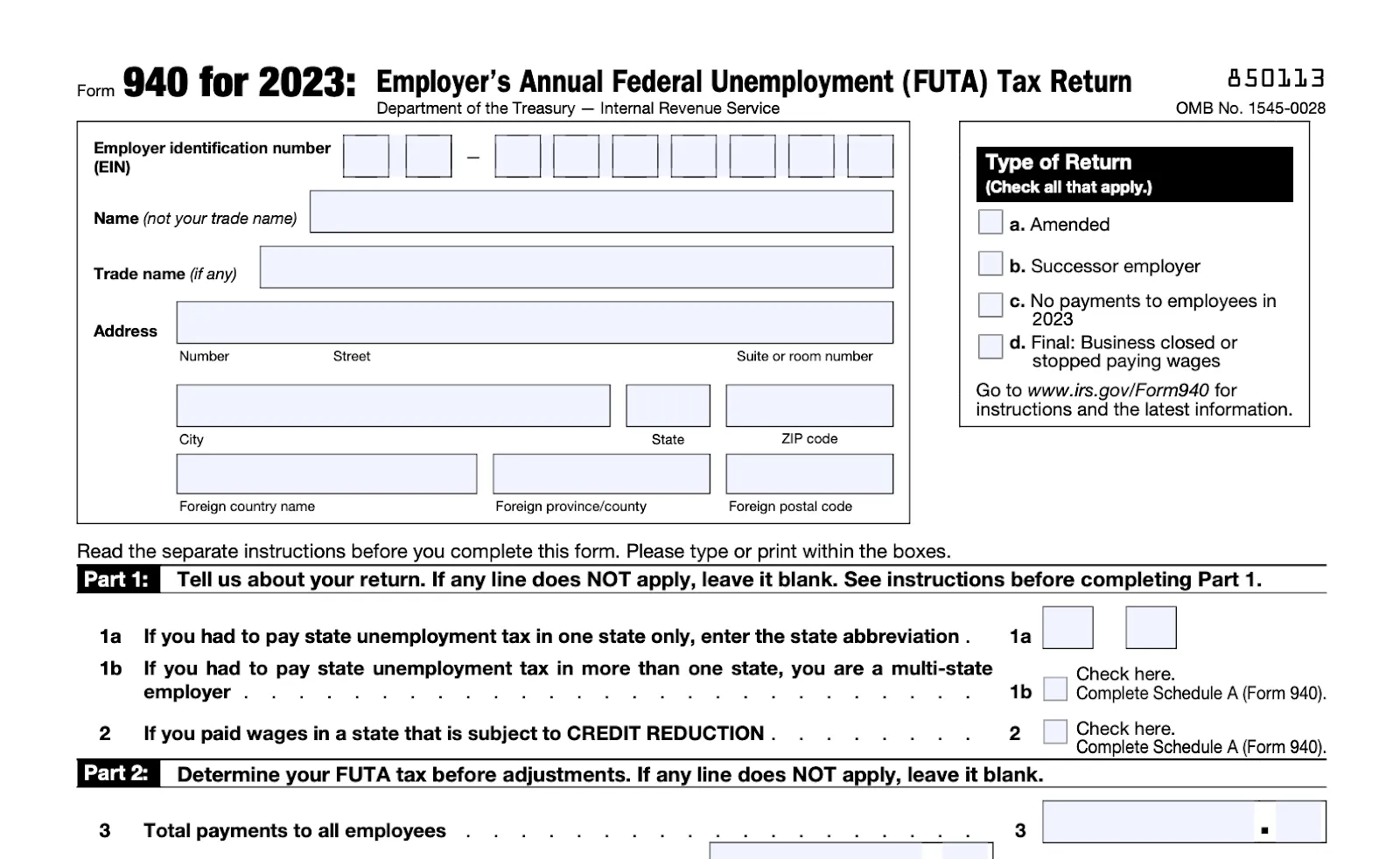

- Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return)

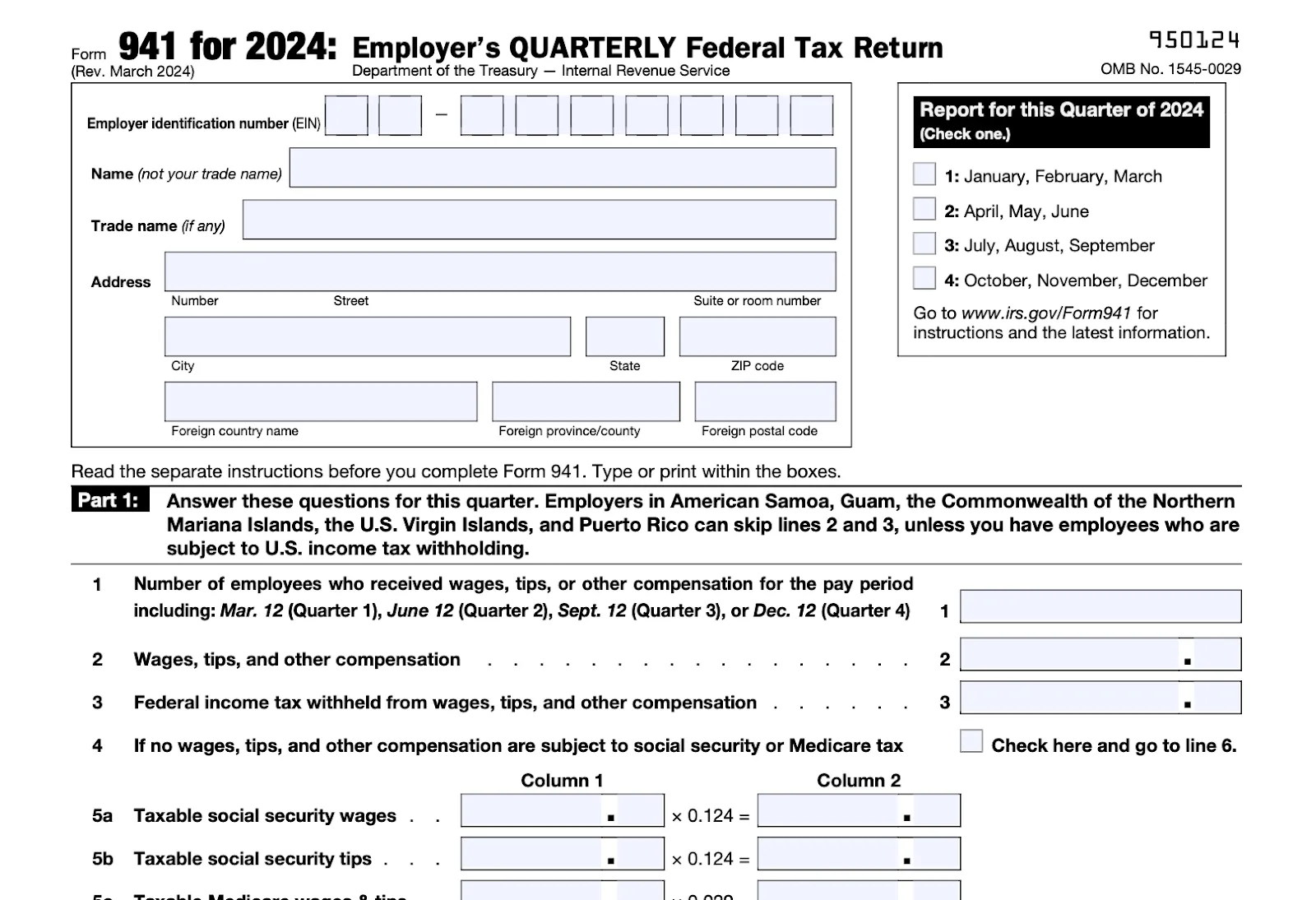

- Form 941 (Employer’s Quarterly Federal Tax Return)

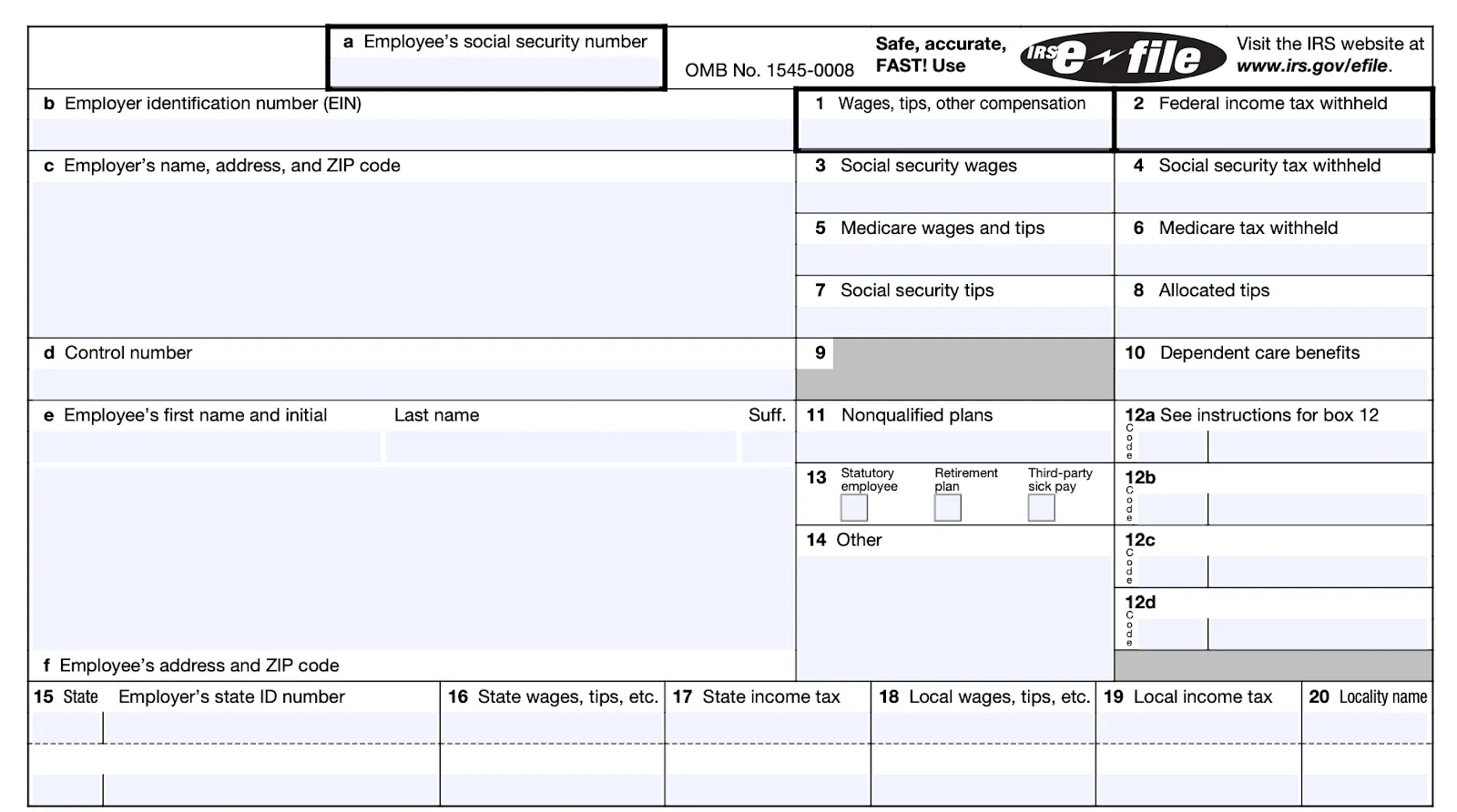

- Form W-2 (Wage and Tax Statement)

Here’s a quick rundown of each form.

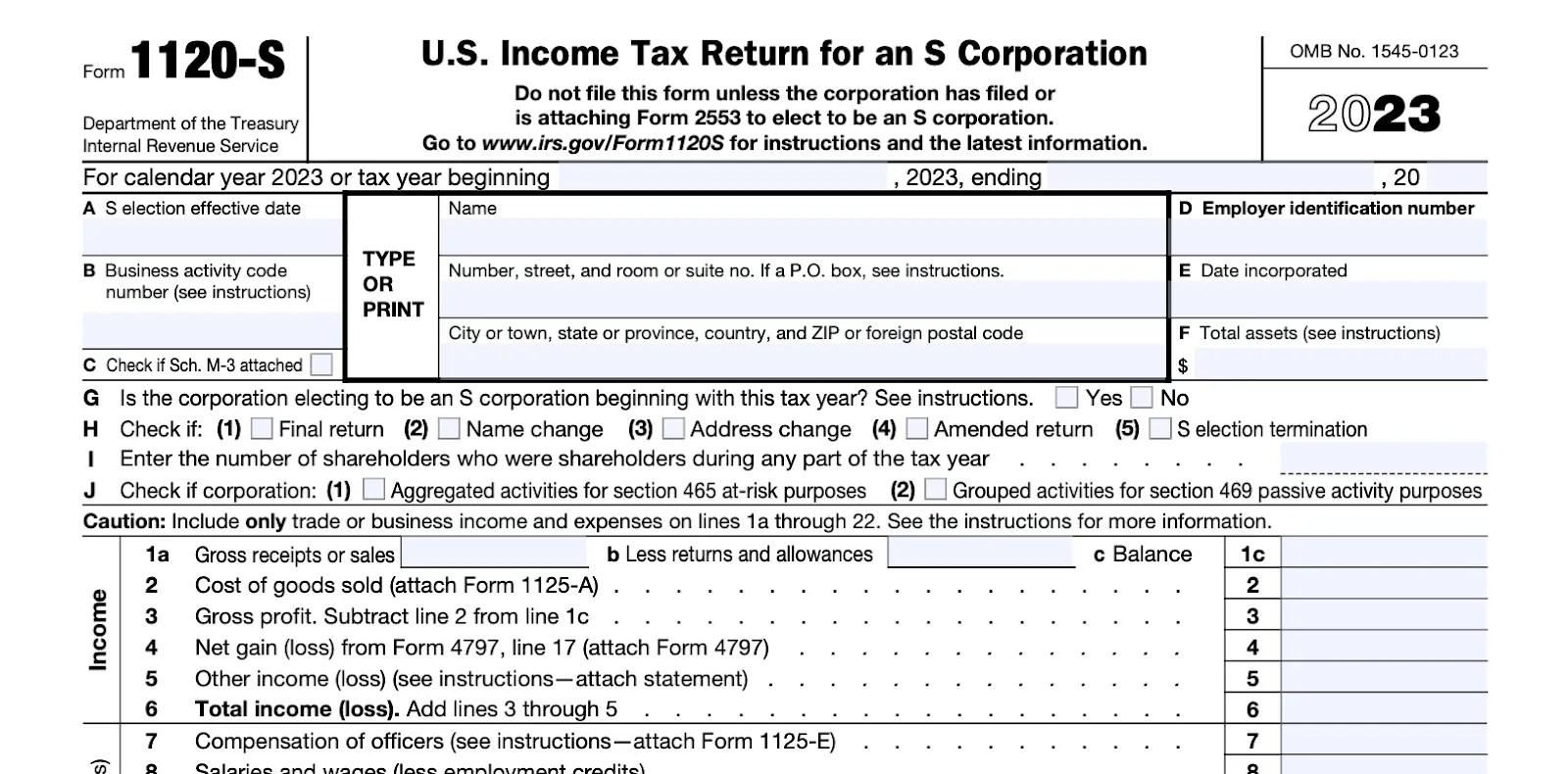

Form 1120-S (US Income Tax Return for an S Corporation)

Deadline to file: March 15 (or the 15th day of the third month of your financial year)

Form 1120-S is the annual income tax return for your S corporation. It reports all of your S corp’s revenue, deductible expenses, and profits for the year. Importantly, it also reports how tax liability for S corp income is passed through to shareholders in the corporation.

Information you need to file Form 1120-S

For this form, you’ll need the information provided by a complete set of financial records for your therapy practice, including year-end financial statements.

Filing Form 1120-S is no small task. For a complete walkthrough, see How to Read an S Corporation Tax Return for your Therapy Practice.

Schedule K-1 of Form 1120-S (Shareholder's Share of Income, Deductions, Credits, etc.)

Deadline to file: April 15

Schedule K-1 reports your share of your S corp’s income and deductions based on how much of the corporation you own.

If you’re the only shareholder, that means 100% of your S corp belongs to you, and 100% of its income and deductions pass through to you.

Schedule K-1 is a part of Form 1120-S, but unlike the rest of Form 1120-S it is due at the same time you file your personal tax return (April 15).

Information you need to file Schedule K-1, Form 1120-S

To fill out Schedule K-1, you’ll need:

- Your personal taxpayer information

- Your percentage share in the S corp

- The total amount of income and expenses that pass through to you based on your ownership in the S corp

- Any additional deductions (e.g. Section 179) you intend to claim

Form 1040 (US Individual Income Tax Return)

Deadline to file: April 15

Form 1040 is your individual income tax return. You use it to report income you earn as an employee of your S corp, as well as the percentage of your S corp’s total income and expenses that passes through to you.

To report your share of pass-through income, attach Schedule E to Form 1040.

What you need to file Form 1040

For a complete rundown of all the information you need to file Form 1040, check out How to Read a Personal Tax Return for your Therapy Practice.

Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return)

Deadline to file: January 31

Employers must file Form 940 annually. Form 940 reports all the wages paid to employees over the course of the year, and the amount of FUTA (Federal Unemployment Tax Act) tax paid by the employer.

Note that you only use this form to report your FUTA contributions as an employer. Contrast this with Form 941 (covered below), which you use to report FICA (Federal Insurance Contributions Act). That includes both employer contributions and withholdings from the employee’s paycheck.

Information you need to file Form 940

In order to fill out this form, you will need:

- Your employer identification number (EIN) and other employer information

- Your FUTA tax rate. By default, it’s 6% of the first $7,000 in wages. If you have paid state unemployed tax, however, you can claim a reduction of 5.4%, meaning you pay only 0.6% of the first $7,000 in wages.

- The total amount paid in state unemployment tax for employees

- Employees’ total wages

With this information on hand, and following the instructions on the form, you will be able to calculate the total amount of federal unemployment tax you owe.

Form 941 (Employer’s Quarterly Federal Tax Return)

Deadlines to file:

- Q1: April 30

- Q2: July 31

- Q3: Oct. 31

- Q4: Jan. 31

Employers are required to file Form 941 on a quarterly basis. This form reports income tax, Social Security, and Medicare taxes withheld from employees’ wages.

The amount of income tax withheld will depend upon each employee’s tax bracket and total wages.

For the other taxes (FICA):

- Social Security taxes are 12.4% of each employee’s wages

- Medicare taxes are 2.9% of each employee’s wages

Combined FICA taxes come to 15.3% of an employee’s wages, with half (7.65%) withheld from each employee’s paycheck and the other half (7.65%) paid by the employer.

Information you need to file Form 941

- Employer information, including EIN

- Total taxes owing in each category

- Adjustments for sick pay and group-term life insurance contributions (these are not subject to FICA)

- The deposit schedule you follow for making Form 941 payments to the IRS

Form W-2 (Wage and Tax Statement)

Deadline to file: January 31 (employer) / April 15 (employee)

Form W-2 is filed by an employer. It reports all the compensation paid to an employee over the course of the year.

The employer submits one copy to the relevant employee (in this case, that’s you) and another copy to the IRS.

If you’re not the sole employee of your S corp, be prepared to complete and file a W-2 for each employee you have working for you.

Information you need for Form W-2

In order to fill out this form, you will need:

- State and local tax information for the employee (including state ID number)

- Employee information (name, address, social security number, etc.)

- Total employee income for the year

- Federal taxes withheld (broken down into income tax, social security, etc.)

{{consult}}

Prepare your state corporation annual report

If your practice is like most S corps, it’s registered with the state where you operate as an LLC or equivalent corporate structure, and elects S corp status at the federal level.

Regardless of which state you’ve incorporated in, you’re required to file an annual report each year in order to maintain LLC (or equivalent) status. Filing also typically comes with a fee.

Check out the Complete Guide to LLCs for Therapists to review filing fees by state.

The information you include in your annual report is made available to the public by your Secretary of State or equivalent.

Here’s the information you need in order to file:

- Your company’s legal name

- Your practice’s address

- The name of your registered agent

- You registered office address

- The names and business addresses of your LLC’s managers and members

Each state has its own forms and processes for filing. Check with your Secretary of State for more information.

Budget for next year’s quarterly taxes

As an S corp, your practice must file quarterly estimated taxes.

In order to qualify for the safe harbor rule when paying quarterly taxes, you need to pay the equivalent of at least 100% of what you paid in taxes for the previous year.

So, whatever you end up owing in taxes for the present financial year, you should be prepared to pay the same amount—divided by four and paid on a quarterly basis—over the course of the year to come.

Once you have a P&L for your present year, you should be able to get a ballpark figure of what you’ll owe next year by looking at past filings.

For instance, suppose you earned $100,000 in taxable income in 2023. At the end of 2024 you prepare your P&L, look at your list of deductible expenses, and determine your taxable income is around $110,000. That means you’ll pay roughly what you paid in taxes in 2023, plus 10%.

Once you have that number, you can start planning. Creating a budget for next the following year, you can prepare now for the quarterly payments you’ll need to make later, and avoid any surprises.

For more help planning quarterly estimated tax payments, check out our complete guide to quarterly estimated taxes for therapists.

—

Still new to the S corp business structure? Check out our complete guide to S corps for therapists.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult their own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Bryce Warnes is a West Coast writer specializing in small business finances.

{{cta}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.

Our team of third-party tax preparers files your business and personal annual tax returns, both federal and state. Schedule a free consult to learn more.

Schedule a free consult