You need to pay yourself as a self-employed therapist. But how, how much, and how often?

Gone are the days of simply receiving a paycheck from an employer. You’re your own boss now, and it’s up to you to make sure you follow best practices for bookkeeping, budgeting, and withholding taxes.

The exact method of paying yourself varies according to whether your practice is a sole proprietorship, an S corporation, or a limited liability company (LLC) filing as an S corp or disregarded entity.

Beyond that, it’s just a matter of following the right steps. Here’s how.

{{consult}}

How to pay yourself as a sole proprietor therapist

If you’re uncertain whether you are a sole proprietor, or if you’re not sure what the difference is between a sole prop and, say, a professional corporation, check out our article on how to choose a business entity as a therapist.

When you’re a sole proprietor, you and your therapy practice are, for tax purposes, identical. All income your therapy practice earns is de facto personal income, reported on your personal tax return (IRS Form 1040).

So, what’s the point of paying yourself at all?

Why you need to pay yourself as a sole proprietor

First things first: Whatever your business entity type, you should have a separate business bank account for all income you earn as a therapist. You should also pay your business expenses from the same account.

Why? To save time and avoid major mistakes.

When you pay your office rent and your apartment rent from the same bank account, it’s harder to keep track of which is which—both for the sake of bookkeeping, and for reporting deductible expenses on your tax return.

When income from your therapy practice transactions mingles with income from—for instance—selling your car, you could end up recording the sale price of a 2012 Prius as revenue on your practice’s books, skewing insights into how much your business is really earning.

For the sake of staying organized, all your therapy practice’s income should go into your business checking account. Until it leaves that account, it’s a business asset. It only leaves that account when it’s being used to cover a business expense. And your owner’s draw is a business expense. More on that in a moment.

When you keep your personal and business assets separated this way, bookkeeping is easy. If you use Heard, we’ll automatically import all your transactions from your business bank account, categorize them, and use them to generate financial statements.

If you do your own bookkeeping using accounting software, it’s typically able to sync with your bank account—meaning you can import all your transactions, categorize them yourself, and create financial statements.

And if you work with a bookkeeper, they can use their own software to import the information from your account.

How to pay yourself an owner’s draw as a therapist

Your owner’s draw is the income you earn from your business and spend on personal expenses.

You can make an owner’s draw from your business bank account by:

- Sending a scheduled, recurring bank transfer

- Sending yourself an e-transfer

- Writing yourself a check

- Withdrawing cash

Whatever method you use, in your general ledger, it’s categorized as the expense “Owner’s Draw.” This is not a tax deductible expense, but an expense reported on the books in order to keep your money organized.

For the sake of budgeting, making financial projections, measuring the performance of your business, and anticipating future bumps along the road, you need to keep track of your owner’s draws. That’s why you categorize them in your general ledger.

A note about owner’s draws and tax withholding

Since you operate a sole proprietorship, you need to pay taxes—income tax and self-employment tax. To cover taxes, it’s typical for sole proprietors to set aside a portion of their pre-tax income—usually 25% to 35%, depending on your income bracket.

You can set aside this money in a separate savings account, or leave it in your business checking account. You can do it on a monthly, weekly, or even daily basis—earmarking a percentage of whatever you earn during that period for taxes. Or you can do it on a per-transaction basis—withholding cash every time a client pays you.

Whatever approach you use, take care to set aside money for taxes before taking an owner’s draw. That is, don’t pay yourself a draw until you’ve set aside a portion of the money you’re paying yourself to cover taxes.

Any money you pay yourself as a draw is taxed at the same rate; if you pay yourself before setting aside money for taxes—and fail to do so once you’ve received the money in your personal account—you could come up short when it’s time to pay.

Scheduling your owner’s draws

You can take your owner’s draws on an as-needed basis, varying their amount according to how much revenue your practice is earning. Or you can set a regular schedule—like salary payments—paying yourself weekly, biweekly, or monthly.

The former approach is one typically taken by small business owners whose businesses are just getting off the ground. In your first year or two of solo practice, your income may fluctuate as you take on new clients, experiment with your work schedule, and generally find your groove as a self-employed therapist.

It’s typical for a sole proprietor whose business has been operating for a while and earns a stable, predictable income to pay themselves a stable, predictable owner’s draw. This not only makes it easy to budget personal expenses, but to create a budget for your business and put together financial projections.

{{consult}}

How to pay yourself as an S corp therapist

If you’ve elected S corporation status for your therapy practice, you’ll need to follow more steps in order to pay yourself.

You’re a shareholder in your S corp—that applies even if there are no other shareholders, and you own 100% of shares—and there are rules that dictate how you receive money from the business.

Considering S corp status, or new to S corps in general? Check out our Complete Guide to S Corporations for Therapists.

Paying yourself with an S corp: Salary vs. distributions

The same principles best followed when paying yourself as a sole proprietor—separating your business and personal bank accounts, properly categorizing money you pay yourself on the books—apply when paying yourself from your S corp.

One big difference: You can’t pay yourself owner’s draws.

There are two ways to pay yourself from your S corp:

- With a salary, typically paid to individuals who perform day-to-day services on behalf of the S corporation and manage its daily operations. In your case, that means practicing as a therapist.

- With a distribution, typically paid to individuals who have capital invested in the S corp, but don’t play a role in its day-to-day operations.

The two forms of payment are taxed differently.

Your salary is subject to FICA (15.3% of your earnings, withheld by the S corp and remitted to the IRS).

Your distributions are not taxed with FICA.

Naturally, distributions may seem like a much more attractive way to pay yourself, due to the tax savings. The IRS has anticipated this, however. If you play a day-to-day role running your business, you must pay yourself a reasonable salary before you take any distributions.

Paying yourself a reasonable salary as a therapist

A reasonable salary, according to the IRS, is a salary “commensurate with your duties.”

For instance, if you spend 25 hours each week seeing clients, at a rate of $130 per hour, would it seem “reasonable” for you to earn just $2,000 per month in wages?

Probably not—and certainly not in the eyes of the IRS. If you were to take a miniscule salary (subject to FICA) while earning large distributions (not subject to FICA), the IRS would likely notice. You could face unexpected adjustments to your return (resulting in more taxes owed), possibly an audit, and perhaps even penalties.

Even if you don’t take distributions, you’re required to pay yourself a reasonable salary (and the taxes that go with it).

So, what’s a reasonable salary for a self-employed therapist?

There’s no one-size-fits all solution. Your salary is determined by factors like:

- Your level of certification

- How much experience you have as a therapist

- How long you’ve been in business

- Your hourly rate

- Living expenses in your area

- Business operating expenses in your area

- The level of demand for therapy in your area

Look at what therapists with comparable skills and experience are earning where you practice. A google search for “therapist salary in X” can offer a rough estimate. So can a visit to your public library, which may have a directory of typical salaries for different positions.

You may also choose to consult with an accountant who works with other therapy practices.

Setting up payroll for your S corp

As an employee of your S corp, you’ll have taxes—including federal income tax, FICA, and state taxes—withheld from your pay.

For its part, your S corp will need to report tax withholdings annually to the IRS with IRS Form W-2, report your unemployment insurance eligibility with IRS Form 940, report wages and withholdings quarterly with IRS Form 941, and possibly tackle other paperwork.

If your practice was a large corporation, you might have an in-house payroll department to handle all of this. But since you’re a small business, you’ll either need to do it yourself or outsource the work to another individual or business.

There are a large number of companies offering payroll services for small businesses. Some may be based locally, in your city. Others offer online, software as a service (SaaS) solutions regardless of your location. Heard payroll is powered by Gusto.

Whatever solution you use will cost money, but it will save you the time, trouble, and potential pitfalls—like incorrectly filing forms or remitting the right amount of tax—involved in managing your own payroll. Consider it a cost of doing business and maintaining peace of mind.

How much to pay yourself when you run a solo therapy practice

Even if you’re paying yourself owner’s draws from a sole proprietorship and you aren’t concerned with meeting IRS requirements for a reasonable wage, it can be difficult deciding how much to pay yourself.

Besides paying your salary and covering your practice’s other day-to-day expenses, your revenue can be used to:

- Save up to cover your living costs during a leave of absence

- Reinvest in the form of marketing for your business

- Eventually expand the services you offer by hiring employees

- Put aside money in case of a rainy day or unexpected shortfall

- Prepare for seasonal changes in revenue, like the summer slowdown

You can work out how much to pay yourself by planning out allocations with the help of an accountant or your accounting team at Heard.

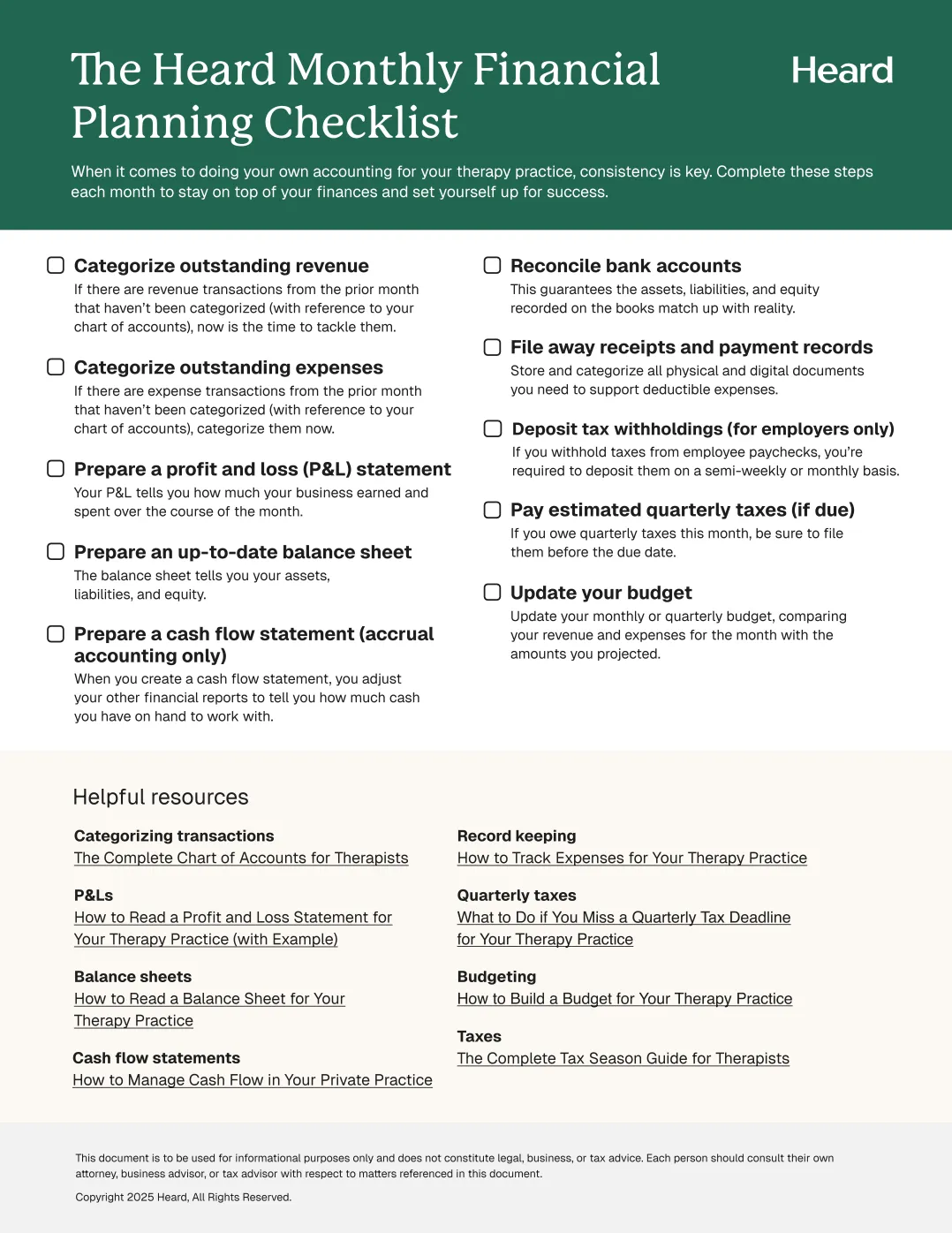

Income Allocations (example)

It’s worth taking all of these into account, even if it’s only your first year in business as a solo practitioner. The work you do for your business, and the work you pay yourself for, is an investment in the future.

Preparing now for professional ups and downs in the future may mean cutting yourself a smaller paycheck now, but it pays off in the long run.

—

It’s essential you include your owner’s draw and salary in the budgets you create for your business, so you can maintain a healthy cash flow and cover all your expenses. Learn more from our guide to budgets for therapists.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult their own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Bryce Warnes is a West Coast writer specializing in small business finances.

{{resource}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.

We help you determine how much to pay yourself and set aside for taxes each month. Book a free consult to learn more.

Schedule a free consult