Making your therapy practice an S corporation (S corp) can be hugely beneficial.

When you elect S corp status, you enjoy a lot of the good things that come with forming a C corporation—like reduced personal liability—while potentially reducing your tax burden.

Here’s everything you need to know about how S corporation status works, potential drawbacks to look out for, and how to elect S corp status for your therapy practice.

{{resource}}

What is an S corporation?

When you run your own business, you have a variety of business structures to choose from, including:

- Sole proprietorship

- Partnership

- Limited liability companies (LLCs)

- Corporation

Your business structure determines how your income is taxed, your level of personal legal and financial liability, and who can share ownership of your business with you. For a full rundown, check out our complete guide to business entities.

Technically, “S corporation” does not describe a business structure, but a “filing status.” Your filing status is something you elect—or choose—when you file your taxes with the IRS.

Electing S corporation status

Both LLCs and corporations have the option of electing S corporation status. Sole proprietorships and partnerships do not.

Electing S corp status affects how your income is taxed by the IRS, and how your therapy practice’s profits are passed on to its shareholders. You do not need any shareholders besides yourself in order to elect S corp status.

Typically, you register your LLC or your corporation (by filing articles of formation or articles of incorporation, respectively) with your state. Then you elect S corp status with the IRS by filing IRS Form 2553. Depending on where your business is registered or incorporated, you may need to file a similar form with State tax authorities.

How S corporations are taxed

An S corporation is what’s known as a pass-through entity. All income is passed on from the S corporation to the individuals who own it. Although the S corp files a tax return—using IRS Form 1120-S (US Income Tax Return for an S Corporation)—the business entity does not pay taxes on its own income.

S corps vs. C corps

The C corporation is the default business structure when you incorporate. Meaning, if you file articles of incorporation, but you don’t elect S corp status, your company is a C corporation.

The biggest difference between S corps and C corps is in how they are taxed. Any income a C corporation earns is taxed at the corporate rate of 21 percent. Any money leaving the corporation in the form of salaries or dividend distributions is then taxed again according to the income tax bracket of the individual earning them. That’s what is meant by “double taxation” when it comes to corporations.

On the other hand, if you elect S corporation status, your corporation does not pay taxes on the income it earns. Instead, all income is passed to shareholders, who are then taxed at their individual tax rates.

In contrast with a C corp, an S corp must meet certain requirements when it comes to shareholders. That includes having no more than 100 shareholders. Also, only US residents may hold shares. Finally, an S corp is only able to issue one class of stock.

Like a C corp, a corporation with S corp filing status must elect a board of directors and hold shareholder meetings.

S corps vs. LLCs

The LLC business structure is one you register at the state level. Different states have different requirements in regards to registering LLCs. Your Secretary of State should be able to provide that information—or you can check out our state-by-state therapy practice startup guides.

LLCs have a number of options when it comes to federal tax filing. They can elect C corp, S corp, or partnership status. If multiple people own an LLC, they’re referred to as members. They may be considered partners or shareholders depending on the tax filing status the LLC elects.

If you are the sole member of your LLC, you may elect S corp status, becoming (for tax purposes) an S corporation with a single shareholder.

You benefit from reduced personal financial and legal liability—your practice, an S corp, is distinct from you, an individual—and you aren’t required to pay self-employment tax (provided you are paid as an employee of your S corporation). At the same time, you avoid complicated tax filing and reporting requirements.

Partly for these reasons, Heard helps clients form single member LLCs for their therapy practices.

Paying yourself as a single-member S corp

When your therapy practice is a single-member S corporation, there are two ways you can pay yourself:

- With a salary

- With shareholder distributions

In almost all cases, if you contribute to the day-to-day operations of your business, you are required to pay yourself a “reasonable salary” (more on that in a moment). You may also pay yourself shareholder distributions, but only in addition to your salary.

Paying yourself a salary from your S corp

Being paid a salary by your own S corp is the same as being paid a salary by any other business. Your income tax and FICA tax are withheld from your paycheck by the S corp, and paid to the IRS. The S corp makes FICA contributions and pays employment tax. You do not personally pay the 15.3% self-employment tax.

The IRS requires you are paid a “reasonable salary” based on the work you do. Learn more about setting a reasonable salary as a therapist.

At S corps with multiple shareholders, salaries are typically paid to those who work directly for the business on a day-to-day basis, rather than those who have only invested capital in the business and play an advisory role.

In order to pay yourself a salary, you’ll need to set up payroll.

Paying yourself shareholder distributions from your S corp

As a shareholder, you can receive cash distributions from your S corp. Distributions offer more flexibility than a salary—you can adjust their amount according to your needs.

Also, distributions are not subject to payroll tax, employment tax, or FICA. When you receive distributions from your S corp, you pay tax on it when you file your individual income tax return.

Shareholder distributions are typically paid only to those who have invested in the S corporation and primarily play an advisory role—that is, you aren’t involved in day-to-day operations.

Paying yourself both a salary and shareholder distributions

Some therapists whose practices are single member S corporations choose to pay themselves both a salary and shareholder distributions.

One of the benefits of this approach is that you’re able to pay yourself a steady income in the form of a salary, while receiving extra distributions according to your business’s performance.

For instance, when your client list is small, you may receive a regular salary. As it grows—and your profits grow along with it—you may find it’s appropriate to pay yourself a shareholder distribution relative to your S corp’s increased income.

Before settling on any particular method of payment, consult with an accountant.

{{resource}}

What are the benefits of making your therapy practice an S corporation?

Before deciding to form an S corporation, it’s important to consider whether the benefits are worth the extra time and money required to incorporate or register an LLC.

These are the main benefits that S corp therapy practices typically enjoy:

- Pass-through taxation. You don’t suffer the effects of “double taxation” on your income, as you would with a C corporation. You’re only taxed on money you receive from your S corp in the form of salary or wages.

- Reduced liability. Since your S corp is distinct from your person, business debt the corporation assumes—or legal proceedings brought against it—doesn’t typically affect your personal finances.

- Self-employment tax savings. You only pay employment tax on money paid to you as an employee. For instance, if your practice earns $120,000 over the course of the year, but just $80,000 of that is paid to you in the form of salary, you only pay employment tax on the $80,000. Check out Heard’s S corp calculator to estimate your potential tax savings.

- The Qualified Business Income (QBI) Deduction. If your therapy practice is an S corp, there is a good chance you qualify for the QBI deduction. With QBI, you can deduct 20% of qualifying income from their taxes. For more details, check out the IRS page on QBI, or consult with an accountant.

What are the drawbacks of making your therapy practice an S corporation?

Electing S corporation status isn’t the best choice for everyone. There are some factors to take into account before deciding to go this route.

- Incorporation and registration fees. The cost of registering an LLC or incorporating your business varies from state to state. In addition to one-time fees for creating your new business entity, you may be required to pay franchise tax at the state level.

- Hiring an accountant. In almost all cases, businesses hire accountants to help them file articles of incorporation. It’s a complex process, and mistakes can be costly. In addition to the cost of incorporation, you should be prepared to pay annually to have your taxes reviewed and filed by an accountant.

- Your reduced liability can be compromised. If you fail to take necessary steps to separate your personal and business finances, you could pierce the corporate veil, and potentially lose the liability protection S corporations offer.

- More scrutiny from the IRS. Generally speaking, the IRS pays more attention to S corporations than sole proprietorships, and S corporations are more likely to be audited. Making a mistake on your taxes—like missing a deadline—may lead to the IRS withdrawing your S corp status and taxing you as a C corporation.

- Payroll. In order to pay yourself as an employee, you’ll need a payroll solution like Gusto—an added expense for your business.

{{resource}}

When it makes sense to form an S corporation for your therapy practice

There’s no hard and fast rule when it comes to the best time to form an S corporation for your therapy practice.

Most financial advisors recommend forming an S corporation after you reach a certain level of annual profit—typically $100,000—after which point the costs of forming an S corporation are balanced out by the benefits.

At Heard, we typically recommend clients wait to form an S corp until after being in business for at least one year as it can be difficult for a first-time therapy practice owner to project what their annual profit will be, unless they are sure they will make over the $100,000 net income threshold.

Deadlines for filing S corporation status

If you’d like to elect S corporation status, you must file IRS Form 2553 no later than two months and fifteen days after the beginning of the tax year in which you’d like the election to take effect.

If you miss the deadline, you may choose to file your election, and have it take effect the following tax year. Or you may qualify for late election relief.

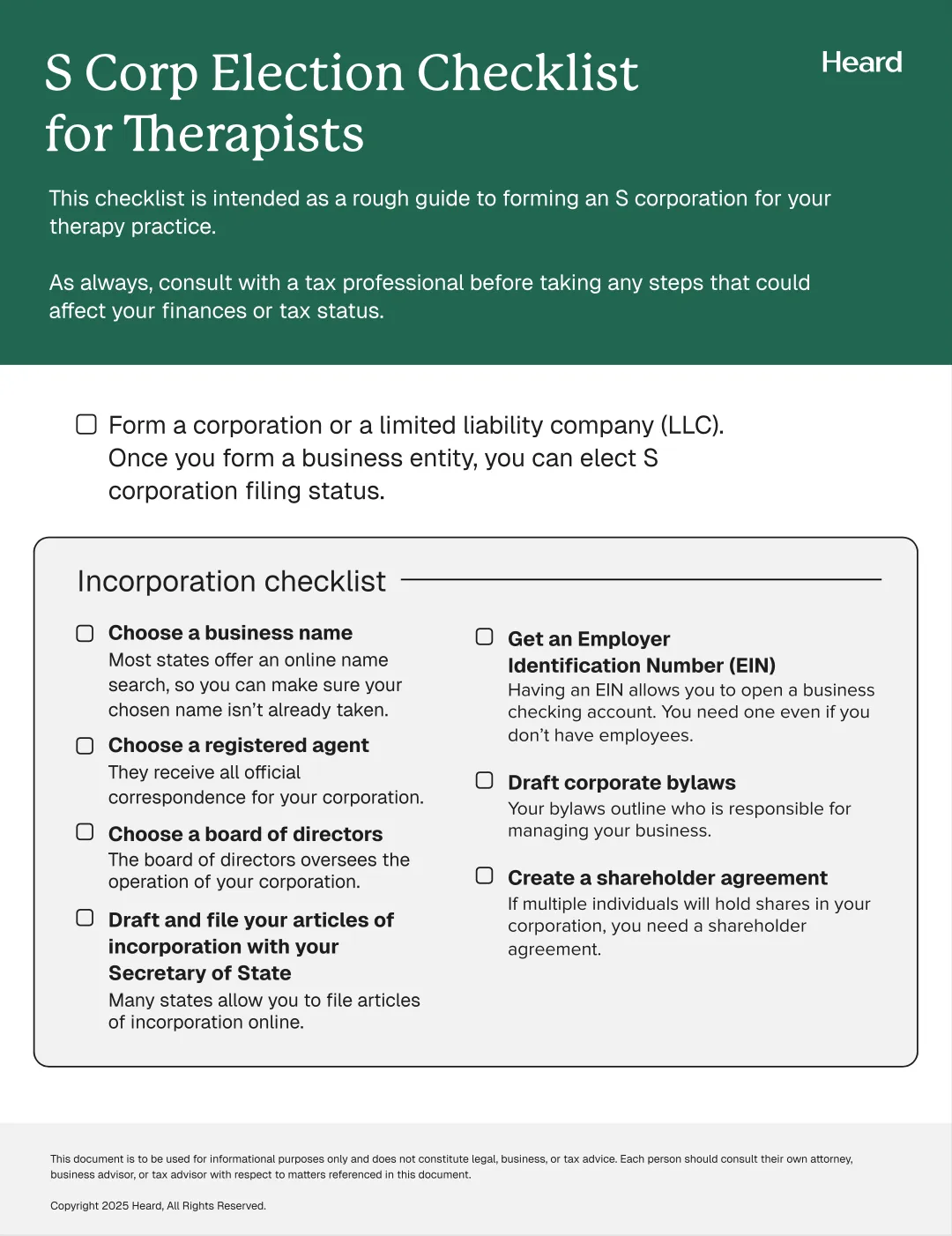

How to form an S corporation for your therapy practice

To form an S corporation for your therapy practice, you need to take two steps:

- Incorporate (file articles of incorporation with your Secretary of State, forming a C corporation) or register an LLC (file articles of organization)

- Elect S corporation status by filing IRS Form 2553

For help incorporating or registering your business, check out our state-by-state guides to how to start a therapy practice.

To fill out Form 2553, you’ll need the following info on hand:

- The date you incorporated, or the date you registered your LLC

- Your Employer Identification Number (EIN)

- The state where you incorporated or registered an LLC

- Your business address

- Contact information for your registered agent

- Contact info and SSN/EINs for each shareholder in your S corporation, as well as the percentage of the business each owns

Once you’ve elect S corporation status, you file your annual taxes using the following forms:

- IRS Form 1120-S (US Income Tax Return for S Corporations), reporting your business’s revenue, expenses, and credits

- Schedule K-1 (Form 1120-S), reporting each shareholders’ share of revenue, income, and credits

Your state taxes may require additional forms and procedures to file your taxes as a corporation or LLC.

—

Want to form an S corp and save money on your taxes? We’ll tell you when it’s the right time to form an S corporation and even file the paperwork for you. Learn more here.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult their own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Bryce Warnes is a West Coast writer specializing in small business finances.

{{cta}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.