Tax credits work differently than tax deductions, but they can still reduce your therapy practice’s tax bill.

The trick is figuring out which tax credits you qualify for. The Mine Rescue Team Training Credit (Form 8923), for example, isn’t likely to be relevant to your therapy practice.

The Work Opportunity Credit (Form 5884), may be—but it depends on a number of factors, including who you decide to hire.

Here’s a breakdown of every tax credit relevant to therapy practices, and what you need to qualify for them.

{{resource}}

Tax credits vs. tax deductions

Tax credits and tax deductions both lower your tax bill, but they do so in different ways.

When you claim a tax deduction on your tax return, the amount you claim is not taxed. For instance, if you claim a $1,500 business expense for the new computer you just bought for your business, your total taxable income is reduced by $1,500. That’s $1,500 income you won’t pay income tax on.

When you claim a tax credit, on the other hand, the total amount of tax you owe is reduced. For instance, if you would typically owe $30,000 in federal income tax for the year, but you claim a $1,000 tax credit, you’ll end up owing $29,000 instead.

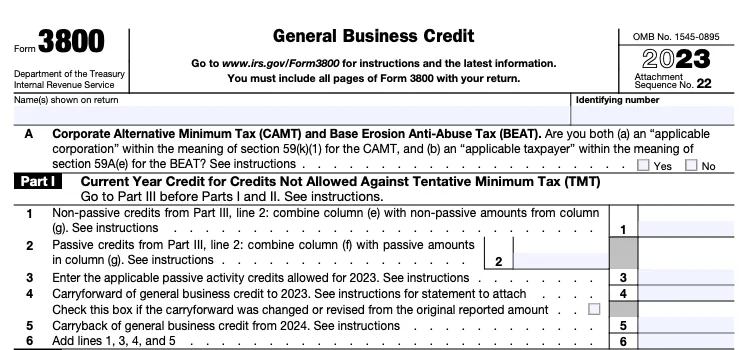

You don’t report your tax credits on Schedule C or Form 1120S, as you would with your practice’s tax deductions (depending on business structure). Instead, you file a separate form for each credit. And you report all of those credits on one master document, the General Business Credit form (Form 3800).

The General Business Credit

Form 3800

The general business credit form, Form 3800, lists all the business credits you are claiming for the tax year. It provides tables to help you work out how much in total you are able to claim. You submit Form 3800 in addition to your other tax credit forms when you file your taxes.

However, if you are a sole proprietorship, you may not need to file a separate form for each credit you claim. You may be able to claim the credits directly on Form 3800 without additional paperwork. Check the instructions for each credit you’re claiming (the instructions are included in the application forms linked below). They’ll let you know whether or not sole proprietors are required to submit the form.

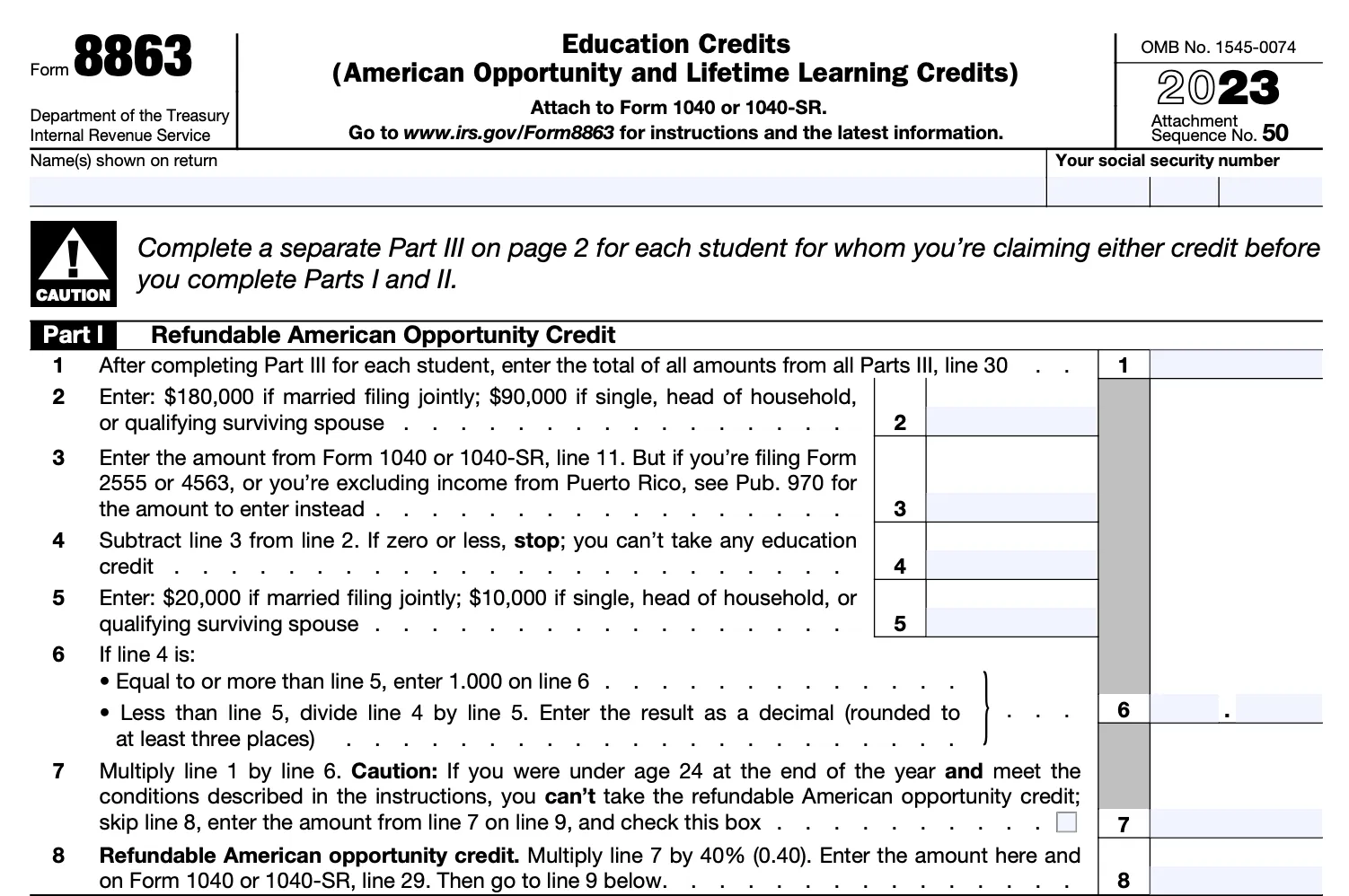

The Lifetime Learning Credit

Form 8863

If you or one of your dependents is pursuing post-secondary education, you can claim 20% of the first $10,000 spent on tuition for the year (to a maximum of $2,000).

Unlike tax write-offs for education expenses, the Lifetime Learning Credit applies to any education received from an eligible institution, not just training relevant to your work as a therapist.

This credit is calculated on a per-household basis, not a per-person basis. The maximum you can claim is $2,000 per year, even if multiple people in your household are going to school.

The credit applies only to tuition, and not to textbooks, student union dues, or other expenses. And it begins to phase out if your modified adjusted gross income (MAGI) exceeds $80,000 (or $160,000 if you’re married filing jointly). For the full rundown, check out our article on the lifetime learning tax credit for therapists.

{{resource}}

The Small Business Health Care Tax Credit

Form 8941

If your therapy practice has employees and you participate in the Small Business Health Options Program (SHOP), you may qualify for the small business health care credit.

The credit is worth up to 50% of your (the employer’s) contributions to employees’ health insurance premiums.

To qualify, you must:

- Have fewer than 25 employees

- Pay an average employee salary of $56,000 or less

- Make employer contribution of at least 50% per employee for employee-only (not family or dependent) care

- Offer each employee a qualified health plan (QHP) through the SHOP Marketplace

- Offer SHOP coverage to all employees working an average of over 30 hours per week

For help determining whether you qualify and the total credit you may be eligible for, use the Small Business Health Care Tax Credit Estimator.

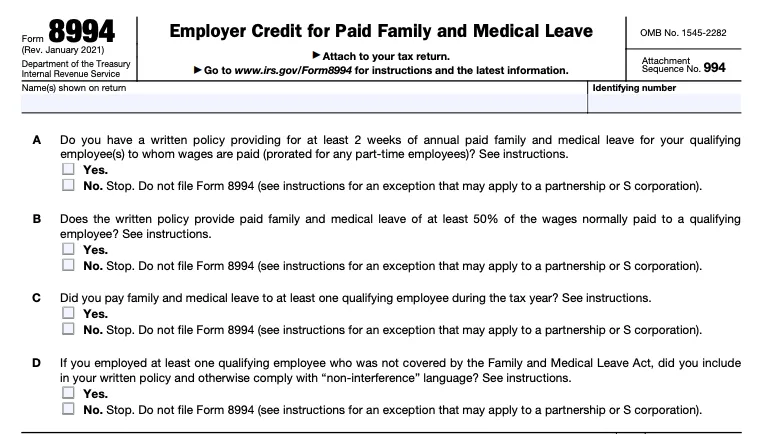

The Paid Family and Medical Leave Credit

Form 8994

If you offer employees of your practice paid medical or family leave, you may qualify for the paid family and medical leave credit.

If you pay an employee 50% of their typical wage or salary during their leave, the tax credit is equivalent to 12.5% of that amount. For each percentage point over 50% you pay, you qualify for another 0.25% tax credit.

In order to qualify, you must:

- Offer each full-time employee two weeks’ paid leave per year

- Pay each employee no less than 50% of their regular salary or wage during their leave

- Have a written paid leave policy in place

The IRS offers guidelines for creating a written paid leave policy.

Paid leave can help employees take time off for:

- The birth or adoption of child

- Caring for a spouse, child, or parent with a serious medical condition

- Undergoing treatment for their own serious medical condition

This credit has increased for 2025. You can learn more from our article New Tax Credits and Deductions for Private Practice Owners.

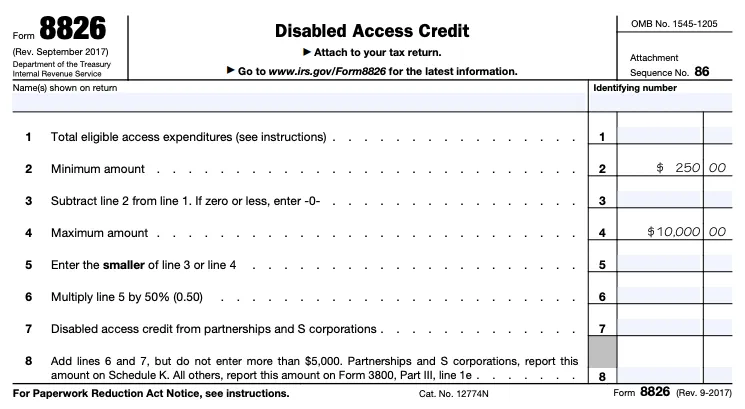

The Disabled Access Credit

Form 8826

If you spend money making your therapy practice more accessible to people with disabilities, you may be able to claim the amount as a tax credit.

In order to qualify:

- Your gross business receipts must be less than $1 million, or you must have no more than 30 employees during the preceding tax year

- The changes you make to increase accessibility must fit the applicable requirements of the Americans with Disabilities Act

The IRS provides some examples of expenditures your business might make in order to be more accessible to people with disabilities:

- Removing physical barriers that prevent people with disabilities from accessing your business

- Providing interpreters or extra materials to people who are seeing or hearing-impaired

- Buying or modifying existing materials (eg. waiting area furniture, washrooms) to make them accessible to people with disabilities

For more guidance, check the instructions to Form 8826.

{{resource}}

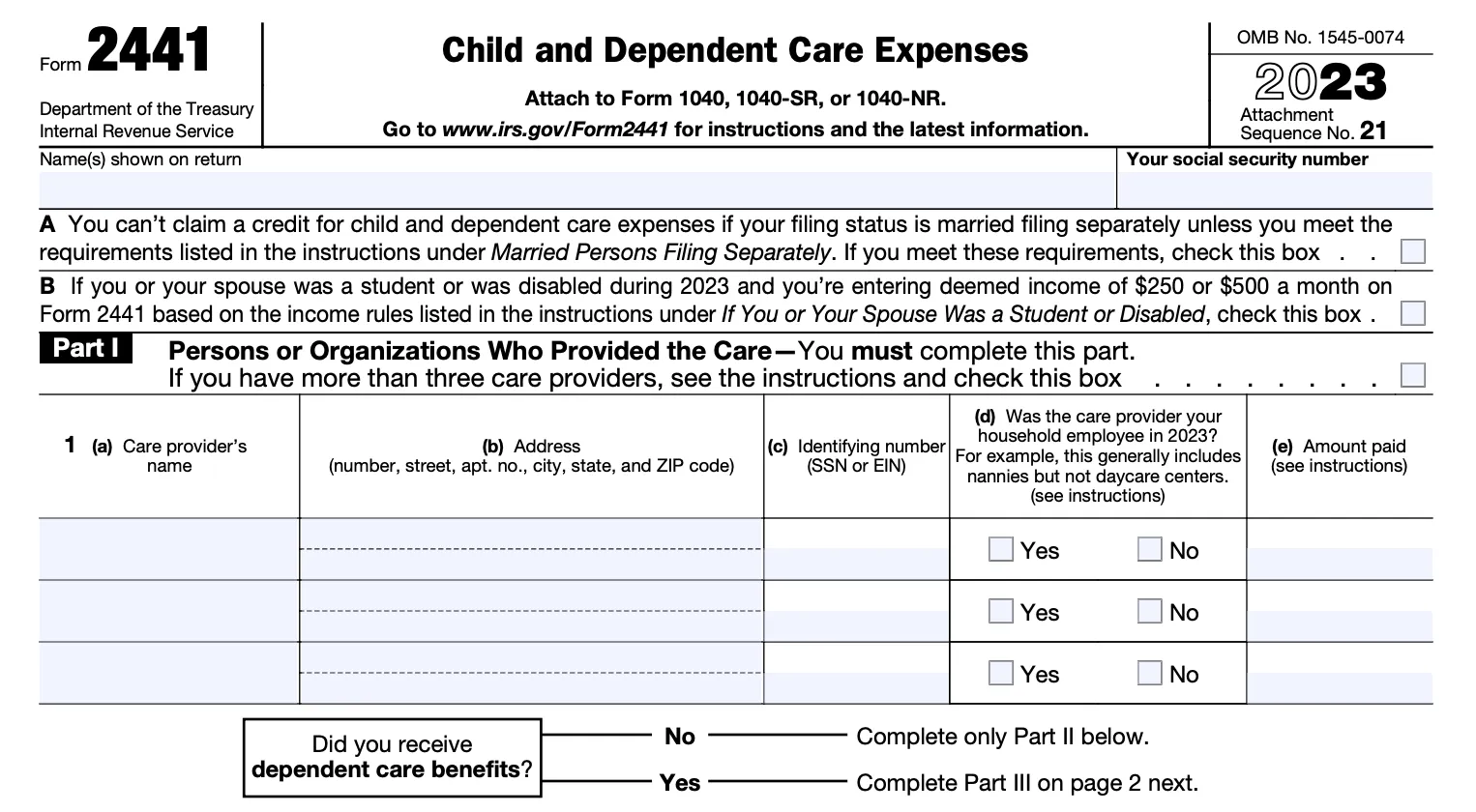

The Child and Dependent Care Credit

Form 2441

If you pay someone to look after your child or another dependent so that you are able to work, you may be able to claim up to $4,000 in tax credit (or $8,000 if you have more than one dependent).

In order to qualify, your AGI must be less than $438,000.

To claim the credit, you’ll need your care provider’s information: name, address, and TIN or SSN. You can request this information by sending them a Form W-10.

The credit applies to a wide variety of care types—from a private nanny or a nanny share, to preschool, to after school programs. For more information, check out the IRS Child and Dependent Care Credit FAQs.

This credit has increased for 2025. You can learn more from our article New Tax Credits and Deductions for Private Practice Owners.

The Small Employer Pension Startup Costs Credit

IRS Form 8881

If you start offering your employees a pension plan, you may be able to claim up to 50% the cost of setting up and administering the plan.

The maximum amount you can claim as a credit is $5,000 the year you set up the plan, $5,000 the year after you first set it up, and $5,000 the year after that—to a total maximum of $5,000. You can’t qualify for this credit any years after that.

One important qualification: At least one of the pension plan participants must be a non-highly-compensated employee. A highly compensated employee is one who:

- Owns more than 5% interest in your business, or

- Received compensation exceeding $125,000 the previous year

Meaning, if you’re the only employee of your business, and you own 100% of it, you do not qualify for this credit when you set up a pension plan for yourself.

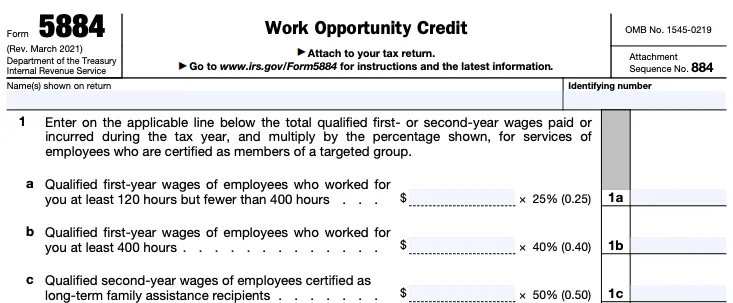

The Work Opportunity Tax Credit

IRS Form 5884

If your therapy practice hires an employee who is a member of a particular group facing barriers to employment, you may qualify for the work opportunity tax credit (WOTC). If you do, you can claim 25% of the wages you pay your employee if they work 120 hours or more the year you hire them, or 40% if they work over 400 hours.

The WOTC differs from other tax credits in that you submit the relevant IRS form to your state’s workforce agency rather than to the IRS. The agency determines whether the employee is eligible.

You must also work with the applicant to complete Department of Labor Form 9061. In some cases, your new employee may already have completed a conditional version of this form, Form 9062, in advance.

Both forms 5884 and 9061 must be filled out and submitted at the time you hire the employee. For instance, if you realized after the fact that one of your existing employees is a member of a qualifying group, and then tried to claim this tax credit, you would not be able to get the tax credit.

Finally, workers are not eligible if they are owners or co-owners of your business, or if they are your direct relatives.

The qualifying groups recognized for the sake of the WOTC include:

- Food stamp recipients

- Qualified veterans

- Qualified IV-A recipients

- Ex-felons

- Long-term temporary assistance for needy families (TANF) recipients

- Qualified long-term unemployment recipients

- Members living in designated areas (empowerment zones or rural renewal counties)

- Vocational rehabilitation referrals

- Supplemental security income (SSI) recipients

- Summer youth employees living in empowerment zones

You can learn more about each of these categories from the complete list of WOTC categories or from the WOTC eligibility chart.

{{resource}}

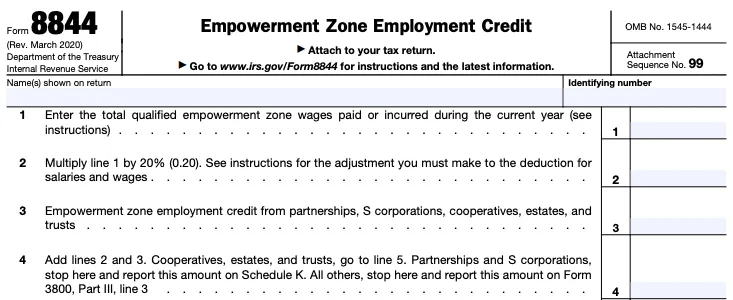

The Empowerment Zone Credit

IRS Form 8844

An empowerment zone (EZ) is an area designated by the Department of Housing and Urban Development and the Department of Agriculture. EZs are distressed urban or rural areas, typically with populations of less than 200,000. Here’s a map of EZs.

If you hire empowerment zone employees, you may be qualified to claim 20% of their salary or wages (to a maximum of $3,000 per employee per year) as a tax credit.

An empowerment zone employee is someone who lives or works within a designated EZ.

Both newly-hired and existing employees qualify your business for this credit. You can apply for the credit every year you have qualifying employees, and there’s no limit on the number of employees you can claim.

—

Looking for more ways to lower your tax bill? Check out our complete list of tax deductions for therapists.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult their own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Bryce Warnes is a West Coast writer specializing in small business finances.

{{cta}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.