If you want to know how much money your therapy practice is making, your profit and loss statements (or “P&L statements”) are the place to start.

Your profit and loss statements tell you how much money is coming into your business, how much it’s spending, and how much cash you keep as profit.

They’re essential for keeping a finger on the pulse of your private practice, and making plans for the future.

{{resource}}

What is a profit and loss statement?

Along with your balance sheet, your profit and loss statement is one of the core financial statements you should generate regularly in order to monitor your business’s financial health. (You may also use cash flow statements if you use the accrual accounting method.)

Profit and loss statements are generated on a monthly or quarterly basis. At the end of the year, you generate an annual profit and loss statement that gives you the information you need to file your taxes.

What kind of information does a profit and loss statement include?

A profit and loss statement tells you:

- Your revenue: the total amount clients paid you over a particular time period.

- Your expenses: the total amount your business spent over a particular period.

- Your profit, also known as the bottom line: your revenue, minus expenses.

How do you generate a profit and loss statement?

You generate a profit and loss statement by taking all of your bookkeeping records for a particular period—usually one month or one quarter of the financial year—and summarizing them in a single document.

Example: To create a profit and loss statement for the month of April, you would look back over your general ledger, and:

- Add up all of your revenue for April

- Add up all of your expenses for April

- Subtract your total revenue from your total expenses to determine your profit

This is a super simplified explanation. The more complex the financial side of your business is, the more complicated it is to create profit and loss statements. Debt, depreciating expenses, and multiple revenue streams can all complicate matters.

{{resource}}

Who is responsible for generating profit and loss statements?

If you have a bookkeeper, or an accountant who works on a monthly retainer, they can generate profit and loss statements for you. If you handle your own bookkeeping using software, whichever app you use should have a built-in function for generating profit and loss statements.

Keep in mind that your profit and loss statements are only accurate if your bookkeeping is also accurate. If you aren’t tracking all of your expenses and revenue, your profit and loss statements won’t reflect reality (no matter how much you pay your accountant each month!).

Profit and loss statements vs. the balance sheet

Along with your balance sheet, profit and loss statements form the backbone of financial reporting for your private practice. But what’s the difference between the two?

Like the profit and loss statement, a balance sheet is generated on a monthly or quarterly basis. But a balance sheet contains different information. While a profit and loss statement tells you about your revenue and expenses, your balance sheet tells you about your assets and liabilities.

In brief, your assets include anything of cash value your business owns, including cash itself. Liabilities, on the other hand, typically take the form of money you owe.

Another way to think of it: Your balance sheet shows you the money you currently have, and the money you need to pay back. Your profit and loss statement shows you the money you’ve earned, and the money you’ve spent.

How to read a profit and loss statement (with example)

If you’re looking at a profit and loss statement for your practice for the first time, it’s easy to get overwhelmed.

Plus, it helps to know which questions to ask—besides “How much am I making?” and “How much am I spending?”—when you look at your profit and loss statement, so you can make the best use of the information on hand.

We’ll get to that in a moment. But first, an example.

Example profit and loss statement for a private therapy practice

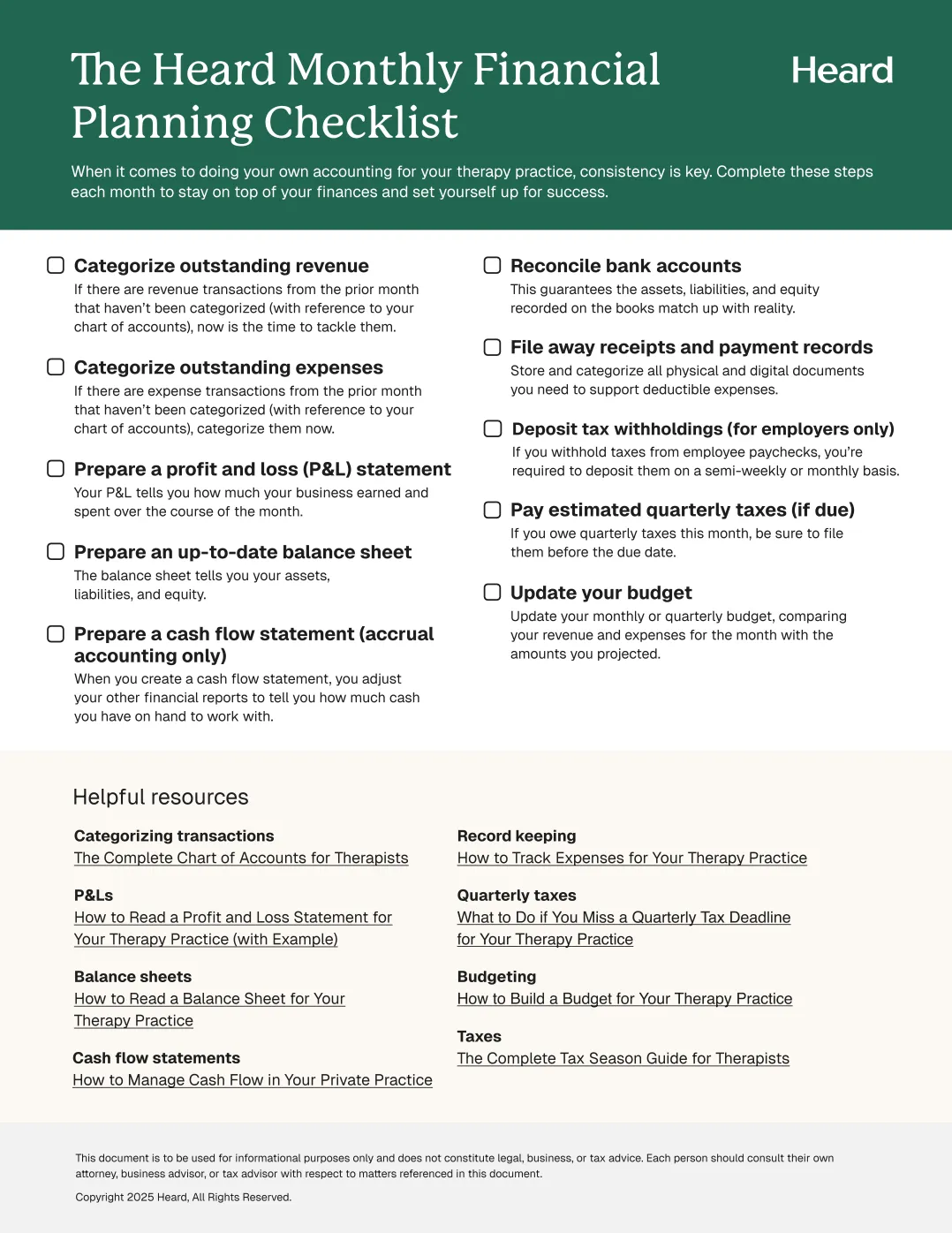

Here’s an example profit and loss statement for the private practice of a fictional therapist named Jessie Goode, a sole proprietor who has an office on the bustling main drag of Everytown, Illinois.

Take a moment to read through the profit and loss statement above. For the sake of this example, it’s fairly straightforward.

Here’s what each part of the statement means.

Business info and statement name

At the top, you’ll find the private practice’s name and contact info. If this statement were created by an accountant, you would also find the name of the accounting firm or individual.

The document is labeled as a profit and loss statement. Most importantly, you’ll also find the period the statement covers—in this case, April, 2022.

Revenue

The left hand column lists types of revenue (this may also be labeled “Gross Income”); the right hand column lists the dollar amount of each revenue stream.

Jessie makes most of her income billing clients (“Services”). But she’s also written and self-published an ebook, and earns some revenue from that (“Sales”).

At the bottom of the revenue section, the practice’s total revenue is listed.

Expenses

Here, we find Jessie’s expenses for the month. Rent, electricity, internet, and phone charges are all part of her practice’s overhead. She also pays monthly for an online marketing service, and for website hosting.

Profit/Loss

This is why the bottom line is called the bottom line: The final item on Jessie’s profit and loss statement lists her total profit (“Profit/Loss”) for the month. (This may also be labeled “Net Income.”) It’s the amount left over after Jessie subtracts all of her expenses from her revenue.

Using profit and loss statements to benefit your business

Suppose Jessie generates a profit and loss statement every month, and she’s been doing it since the day she opened her doors. That gives her some serious insight into how her business is performing, and can help her make plans for the future.

Looking at this statement for April, 2022, she may ask herself:

- How have expenses increased or decreased compared to previous months? Seasonal changes, like a heating bill that increases in winter, can affect profit on a cyclical basis.

- How has revenue increased or decreased compared to previous months? It’s possible some parts of the year may be more profitable, year after year. (For example, gyms typically see a revenue spike in January, as new clients join in an effort to fulfill their New Year’s resolutions.)

- How does this April’s profit and loss statement compare with last April’s statement? Does it mirror last year’s statement in any way (for instance, an increase or decrease in revenue)? Does it differ? Why?

Taking the time each month or quarter to go over your financial statements isn’t just good financial hygiene. It can help you find ways to increase your profits or expand your practice.

—

A profit and loss statement can tell you how much profit you’re earning. But it won’t necessarily tell you how to make your private practice profitable in the first place. For that, check out our article How to Keep your Therapy Practice Profitable.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult their own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Bryce Warnes is a West Coast writer specializing in small business finances.

{{cta}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.